Donate to CKN through Section 80G Deduction

Empowering Change: Supporting Chotanagpur Kalayan Niketan (CKN) through Section 80G Deduction

In a world rife with inequalities and injustices, organizations like Chotanagpur Kalayan Niketan (CKN) stand as beacons of hope, dedicated to empowering women, children, adolescents, and LGBTQIA++ individuals in the districts of Jharkhand state, India. CKN, a women-led organization since 2008, tirelessly works towards advancing the rights and protection of marginalized communities, advocating for their well-being and fostering a more inclusive society. As CKN continues its noble mission, it relies on the support of compassionate individuals and organizations to expand its reach and impact. Donating to CKN not only uplifts communities but also offers significant tax benefits under Section 80G of the Income Tax Act.

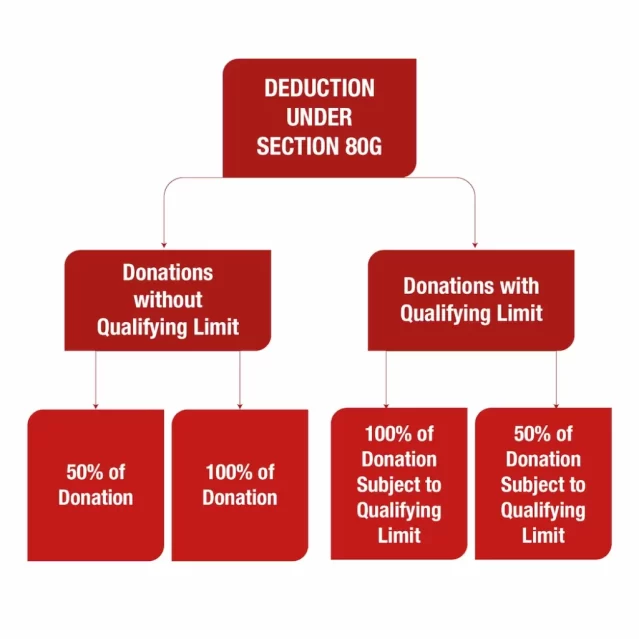

Understanding Section 80G Deduction:

Section 80G of the Income Tax Act serves as a powerful tool for incentivizing charitable giving while offering tax benefits to donors. Individuals contributing to registered NGOs like CKN can avail deductions on their taxable income, thereby reducing their tax liability. By supporting CKN’s initiatives, donors not only make a positive impact on society but also optimize their tax planning strategies effectively.

Deduction for Donations to CKN:

Under Section 80G, donations made to CKN are eligible for deduction subject to certain conditions. Individuals can claim deductions based on the amount contributed, with different percentages applicable based on the nature of the recipient organization:

50% Deduction Subject to Qualifying Limit:

Donations made to CKN fall under this category, enabling donors to claim a 50% deduction on the donated amount with an qualifying limit. This means that every rupee contributed to CKN goes directly towards empowering marginalized communities, with the 50% amount being eligible for tax deduction.

Benefits of Donating to CKN:

Empowering Marginalized Communities: By donating to CKN, individuals contribute directly to initiatives aimed at empowering women, children, adolescents, and LGBTQIA++ individuals in Jharkhand. These contributions enable CKN to provide crucial support, education, healthcare, and advocacy, thereby creating positive change at the grassroots level.

Supporting a Women-Led Organization: CKN’s status as a women-led organization underscores its commitment to gender equality and women’s empowerment. Donors who prioritize supporting women’s leadership and initiatives can find resonance in CKN’s mission and contribute towards building a more equitable society.

Tax Savings: Donating to CKN not only makes a meaningful difference but also offers tax benefits to donors. By claiming deductions under Section 80G, individuals can reduce their taxable income, leading to significant tax savings while supporting a worthy cause.

Obtaining Donation Receipts from CKN:

To avail tax benefits under Section 80G, donors must ensure they receive a valid donation receipt from CKN. The receipt should include essential details such as the donor’s name and address, the amount donated, CKN’s registration number under Section 80G, and the date of the donation. These receipts serve as proof of donation and are essential for claiming deductions during tax filing.

Donate for Impact, Donate to CKN:

As we navigate the complexities of our world, each contribution towards positive change matters. By donating to CKN and leveraging the benefits of Section 80G deduction, individuals not only support transformative initiatives but also amplify their impact on society. Every donation to CKN represents a step towards a more just, inclusive, and compassionate future for all.

In conclusion, supporting Chotanagpur Kalayan Niketan through donations under Section 80G is not just an act of generosity but a strategic investment in social change. As CKN continues its tireless efforts to empower marginalized communities, let’s join hands and contribute towards a brighter, more equitable tomorrow. Together, we can make a difference that reverberates far beyond our individual actions.